Cloud Kitchen Profitability breakdown is the most misunderstood concept in cloud kitchens. Many brands generate strong order volumes on Swiggy and Zomato but still struggle to retain cash at the end of the month. This guide breaks down cloud kitchen profitability in India with real-world examples, explains where margins are made or lost, and shows how professional operators design systems that stay profitable at scale.

Start Here Before Understanding Cloud Kitchen Profitability

This article is part of GrowKitchen’s profitability + operations learning series. If you are new to delivery-first economics, begin with: Cloud Kitchen Business in India.

Accurate profitability depends on clean compliance and reporting. Ensure alignment with FSSAI, structured food safety training via FoSTaC, and purchase visibility through the GST Network.

What Profitability Really Means in a Cloud Kitchen

Many founders confuse revenue with profit. High daily orders often create a false sense of success.

Cloud kitchen profitability is not about how much you sell, but how much you retain after every cost layer.

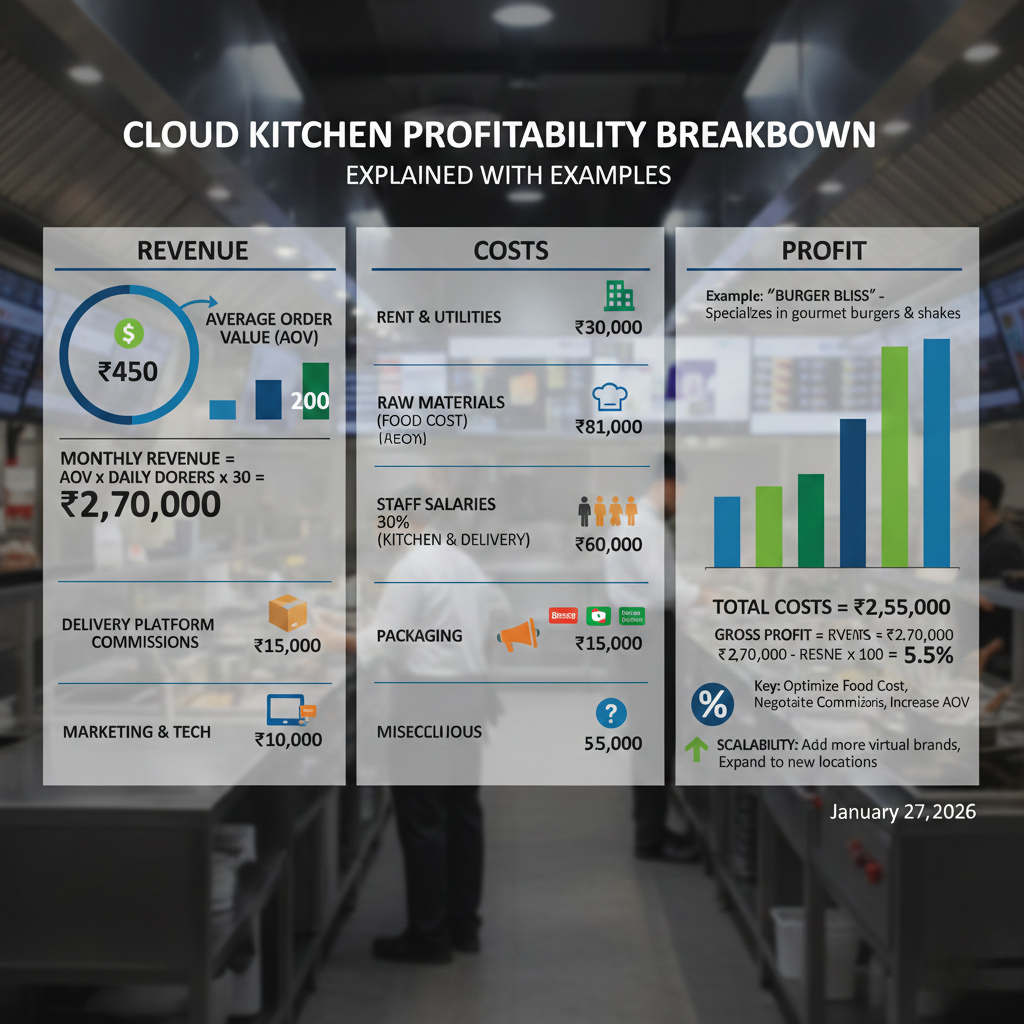

The Full Cloud Kitchen Profitability Breakdown

Profitability must be understood layer by layer. Missing even one layer leads to wrong decisions.

- Menu price (MRP).

- Aggregator commission + taxes.

- Food and packaging cost.

- Delivery discounts and ads.

- Kitchen operating costs.

- Refunds and wastage.

Only what remains after all layers is real profit.

Example: Profitability of a ₹300 Order

Let us break down a realistic cloud kitchen order.

- Order value: ₹300

- Aggregator commission (25%): ₹75

- Net payout before tax: ₹225

- Food + packaging cost (30%): ₹90

- Ad/discount burn: ₹25

- Gross contribution left: ₹110

- Kitchen overhead allocation: ₹80

Final profit per order: ₹30.

A small shift in food cost or discounts can wipe this out completely.

Why Food Cost Decides Profitability First

Food cost is the largest controllable variable.

Professional kitchens target strict food cost ranges before increasing marketing spend.

- 25–28%: Excellent control.

- 28–32%: Healthy and scalable.

- Above 32%: Margin risk.

Learn detailed benchmarks here: Ideal Food Cost Percentage for Cloud Kitchens.

How Aggregator Commissions Impact Margins

Swiggy and Zomato commissions range between 18–30%.

This commission applies before your food cost even begins.

- High commission + low AOV = margin collapse.

- Low margin items suffer the most.

- Discounts magnify commission impact.

This is why menu pricing must be aggregator-aware.

Why Discounts Break Profitability Math

Discounts do not reduce costs. They reduce revenue.

When revenue drops, food cost percentage increases automatically.

- Flat discounts on low-margin SKUs.

- Ads without contribution visibility.

- No post-campaign profitability review.

Many loss-making kitchens are profitable without discounts.

Menu Engineering and Profitability

Not all dishes should have the same margin.

- Hero items with optimized BOM.

- Add-ons with high contribution.

- Combos that lift AOV.

- Limited customization.

Menu engineering stabilizes profitability even during ads.

Read more:

Cloud Kitchen Profit Margin in India

See this – linkedIn.

Fixed Costs That Eat Profits Silently

Fixed costs don’t scale down when orders drop.

- Kitchen rent.

- Staff salaries.

- Utilities.

- Software and tools.

Poor order predictability turns fixed costs into losses.

Refunds, Re-cooks, and Wastage

Refunds directly hit profit, not revenue.

- Late dispatch.

- Poor packaging.

- Inconsistent prep.

- Rating drops leading to lower conversion.

SOP-driven kitchens experience fewer refunds.

Why Systems Decide Profitability at Scale

Profitability cannot depend on memory or instinct.

Systems convert effort into repeatable results.

- Standardized BOMs.

- Portion control SOPs.

- Daily dashboards.

- Menu and pricing reviews.

This discipline is part of the Cloud Kitchen Operations Framework.

Why Scaling Too Early Destroys Profitability

Growth hides inefficiencies.

Scale multiplies them.

Professional operators stabilize unit economics before adding new kitchens or brands.

Final Thoughts: Profitability Is a System, Not a Surprise

Cloud kitchen profitability is predictable when systems are in place.

Revenue creates excitement. Profit creates survival.

Fix margins first. Scale later.

FAQs: Cloud Kitchen Profitability

What is a good profit margin for cloud kitchens?

10–18% net margin is healthy after stabilization.

Are Swiggy and Zomato always unprofitable?

No. Profitability depends on systems and menu design.

When should a cloud kitchen scale?

Only after SKU-level profitability is stable.

Can consulting improve profitability?

Yes. Structured consulting typically recovers 6–12% margin.