CKaaS Revenue Sharing Models Explained

Confused between flat fee, revenue share and hybrid CKaaS models? This guide breaks down how Cloud Kitchen as a Service (CKaaS) partners charge, how the maths works, and which model is right for your food brand.

What Is CKaaS Revenue Sharing?

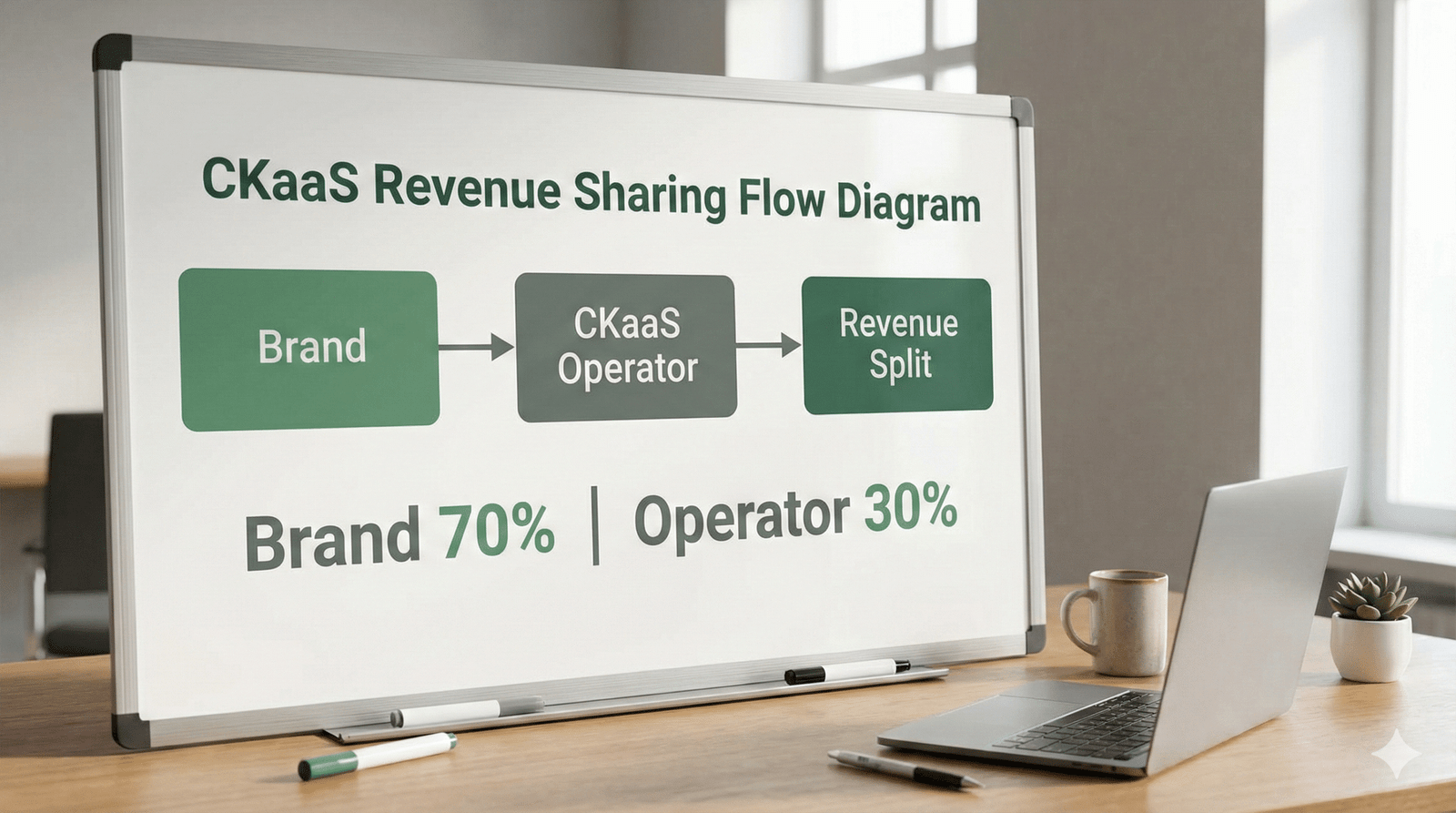

In a Cloud Kitchen as a Service (CKaaS) model, you bring the brand, menu and marketing vision. Your CKaaS partner runs the kitchen operations-staff, infra, supply chain, hygiene and day-to-day execution.

Revenue sharing is simply how you split the money that comes in from orders on Swiggy, Zomato or your own channels. Instead of paying only fixed rent and salaries, you and the CKaaS operator agree to share a percentage of:

- Total sales (gross revenue)

- Or net revenue after aggregator commission

- Or contribution margin after food cost & packaging

Why Revenue Sharing Matters for Food Brands

The way your CKaaS agreement is structured can be the difference between a profitable, scalable brand and a brand that looks good on Instagram but bleeds cash.

Good revenue sharing models help you:

- Align incentives between you and the kitchen operator

- Limit your risk in the first 6-12 months of launch

- Scale to multiple kitchens without heavy capex

- Reward performance when orders and ratings grow

Bad models, on the other hand, can lock you into high payouts even when orders are inconsistent, or push you into unhealthy discounting.

Main CKaaS Revenue Sharing Models

While terms differ between operators, most real-world structures fall into a few clear buckets. Here’s how they typically work in India.

1. Flat Monthly Fee (No Revenue Share)

In this model, you pay a fixed monthly management fee to the CKaaS provider for using their kitchen, staff and systems. There is no % share on your sales.

- Great for brands confident of volume & marketing muscle

- Upside belongs mostly to the brand once orders scale

- Downside: you still pay the flat fee during slow months

2. Pure Revenue Share (No Fixed Fee)

Here, the CKaaS operator takes a percentage of sales instead of a fixed fee. For example, 20-30% of net sales after aggregator commission.

- Lower risk when you’re just testing a brand

- CKaaS partner is directly motivated to grow orders

- At high volumes, payout can feel expensive versus flat fee

3. Hybrid: Fixed Fee + Revenue Share

The most practical model for many brands is a hybrid:

- Lower fixed monthly fee (to cover base ops)

- Plus a smaller revenue share (for performance upside)

This balances risk and reward on both sides, especially when you’re planning to move from 1-2 kitchens to 5-10 kitchens.

4. Performance Slab Model

Some CKaaS partners use slab-based revenue share to reward higher performance:

- 0-5L monthly sales → 25% revenue share

- 5-10L monthly sales → 20% revenue share

- 10L+ monthly sales → 18% revenue share

This encourages both parties to push for higher order volumes and better ratings.

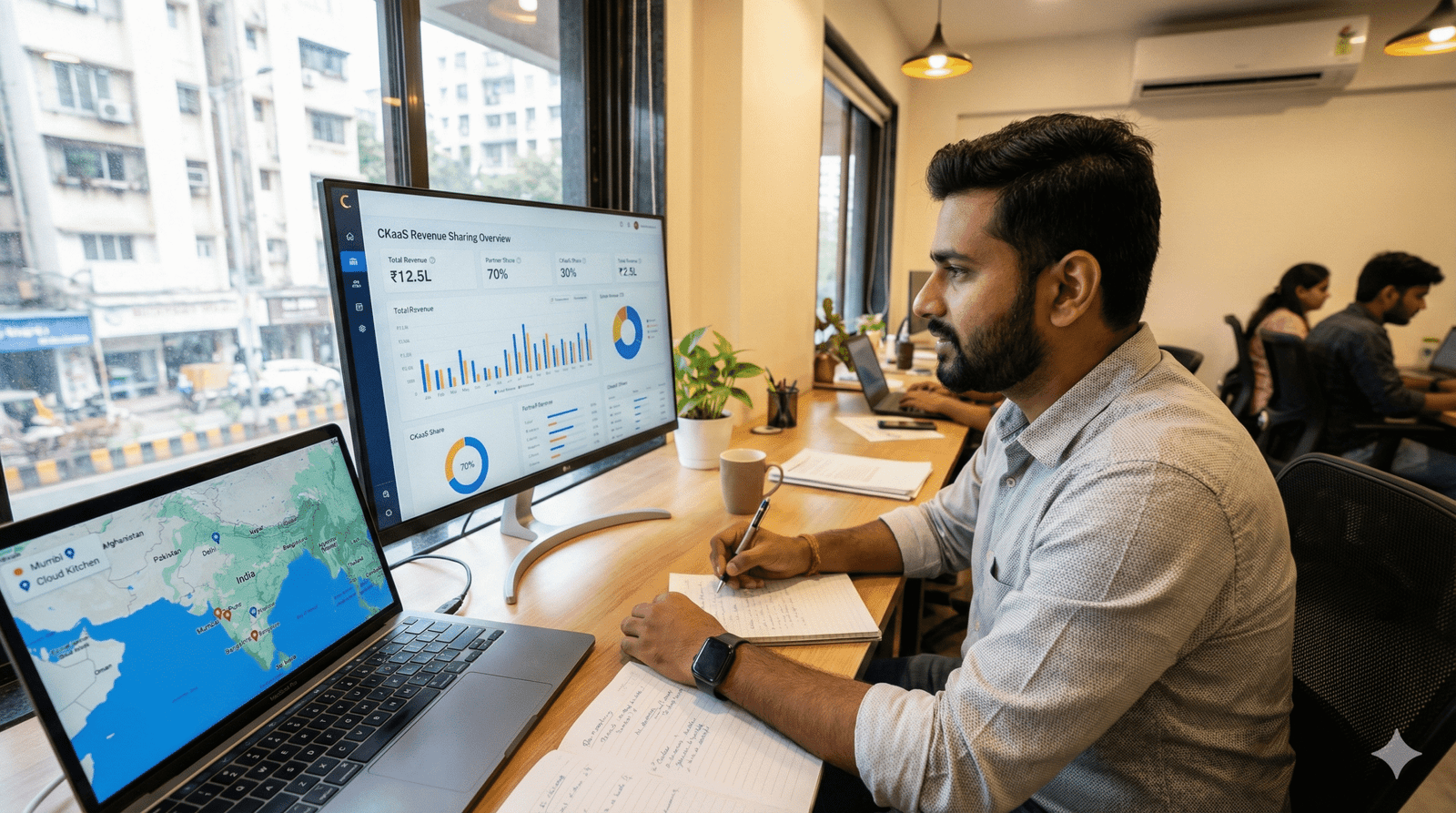

How the Maths Works (Simple CKaaS Revenue Examples)

Let’s keep the numbers simple so you can see how each model behaves in the real world.

Example Setup

Assume one CKaaS kitchen does:

- ₹8,00,000 monthly sales on Swiggy/Zomato

- Aggregator commission: ~25%

- Net sales after commission: ₹6,00,000

Model A: Flat Fee (No Revenue Share)

You pay a flat ₹1,50,000 per month to the CKaaS operator.

- Net sales: ₹6,00,000

- Minus flat fee: ₹1,50,000

- Balance for brand (before food cost & marketing): ₹4,50,000

Model B: Pure Revenue Share (25% of Net Sales)

Instead of a flat fee, you share 25% of net sales with the operator.

- Net sales: ₹6,00,000

- Revenue share (25%): ₹1,50,000

- Balance for brand: ₹4,50,000 (same as above in this case)

At ₹8L monthly sales, both models look similar-but they behave very differently if sales drop to ₹3L or rise to ₹15L.

Model C: Hybrid (₹1,00,000 + 10% of Net Sales)

Now, let’s mix both:

- Flat fee: ₹1,00,000

- 10% of net sales (₹6,00,000) = ₹60,000

- Total payout to CKaaS: ₹1,60,000

- Balance for brand: ₹4,40,000

See this-LinkedIn

Which CKaaS Revenue Model Is Right for You?

There is no one-size-fits-all answer, but here’s a simple way to think about it:

If You Are Testing a New Brand

- Consider pure revenue share or low flat fee + share

- Protect your downside while you validate menu, packaging and ratings

If You Already Have Strong Demand / Audience

- Flat fee or hybrid with lower revenue share makes more sense

- You keep more upside when orders start compounding

If You’re Scaling from 1-2 to 5-10 Kitchens

- Use a hybrid or slab model tied to performance metrics:

- Monthly sales, order count, ratings, repeat rate

- Clear review clauses every 6-12 months

A CKaaS partner like GrowKitchen can structure brand-friendly revenue models that keep expansion realistic and cashflow positive.

Red Flags to Watch Out For in CKaaS Deals

Before you sign any CKaaS agreement, watch out for these warning signals:

- Revenue share on gross, not net: Sharing before aggregator commission can kill margins.

- No clarity on food cost responsibility: Who buys RM? Who controls wastage?

- Long lock-in with no performance clause: You’re stuck even if orders are poor.

- Hidden charges: Extra “service” fees for everything from packaging to basic reports.

Ideally, your agreement should clearly spell out who owns the brand, data, recipes, aggregator IDs and customer relationships along with the revenue model.

FAQ: Revenue Sharing & CKaaS in India

What is a typical CKaaS revenue share percentage?

It varies, but many operators work between 15-30% of net sales, depending on whether there is a fixed fee, who bears food cost and the maturity of the brand.

Is revenue share better than a flat CKaaS fee?

For early-stage brands with limited capital, revenue share or a hybrid model offers more flexibility. For scaled brands with strong demand, a flat fee can be more profitable.

Can investors earn from CKaaS revenue share?

Yes. Some structures allow investors to fund kitchen build-out and recover their money via a percentage of CKaaS management fee or revenue share till principal + returns are paid back.

How do I negotiate a fair CKaaS revenue model?

Start with your unit economics: food cost, aggregator commission, packaging, GST, marketing. Then work backwards to see what you can sustainably share while keeping at least 15-20% net profit after all expenses.

Want a Custom CKaaS Revenue Model for Your Brand?

GrowKitchen designs brand-first CKaaS structures with transparent fees, clear revenue sharing and full operational support across Mumbai & Pune.

Book a Free 30-Minute CKaaS Strategy CallGet a Custom Cloud Kitchen Plan for Your Brand

Not sure how to start or scale your cloud kitchen in India? Share a few details about your brand and we’ll send you a personalised setup and growth roadmap.

- City-wise kitchen and location suggestions

- Approximate investment & profit estimates

- Menu and positioning recommendations

- Whether CKaaS or own kitchen suits you better

Fill the form and our team will get in touch within one working day.

About Us

Ckaas Sloutions

Contact

Follow On

© 2025 Grow Kitchen. All rights reserved.

WhatsApp us