A cloud kitchen expansion strategy in India is not “open more kitchens.” It’s a disciplined system to replicate unit economics, food quality, and delivery performance-without burning cash or losing ratings. Most expansion failures happen because founders scale demand before stabilising operations: inconsistent SOPs, weak vendor control, kitchen-to-kitchen taste drift, and pricing that collapses under Swiggy/Zomato commissions. This guide explains how to expand cloud kitchens in India step-by-step, choosing the right model (distributed vs central hub), designing launch waves, setting expansion KPIs, and building a repeatable playbook for 1 kitchen to 10+ locations.

Start Here Before Planning Cloud Kitchen Expansion

This article is part of GrowKitchen’s scaling and operations series. If you’re still learning how delivery-first kitchens work, start with: Cloud Kitchen as a Service (CKaaS) and then Cloud Kitchen Business in India.

Expansion also increases compliance exposure. Make sure each new unit stays aligned with FSSAI, proper invoicing via GST Network, and local fire, waste, and labour norms (varies by city and municipal ward).

Cloud Kitchen Expansion Strategy in India Explained

Cloud kitchen expansion in India means replicating a profitable kitchen unit into new locations while protecting three non-negotiables: contribution margin, ratings, and repeat orders. Expansion is not a marketing problem. It’s a replication problem.

The best expansion strategy is built on one simple rule: scale only what is stable. If your current kitchen is profitable only because of discounts, or your ratings fluctuate due to prep inconsistency, expansion multiplies those leaks.

Prerequisites: What Must Be True Before You Expand

Before you open a second kitchen, your first kitchen must be “copy-ready.” Copy-ready means the unit does not rely on founder heroics. It runs on systems. If expansion is on your roadmap, lock these prerequisites first:

- Stable food cost % by SKU (weekly tracking, not monthly)

- Documented SOPs for prep, portioning, packing, and dispatch

- Repeatable menu with controlled SKUs and predictable demand

- Vendor master + substitutes with quality specs, not “best price wins”

- Packaging performance validated in real deliveries (heat + moisture control)

- Clear KPIs: contribution margin/order, refunds, late dispatch %, rating stability

If you don’t have SOP discipline yet, fix this foundation first: Cloud Kitchen SOP Checklist.

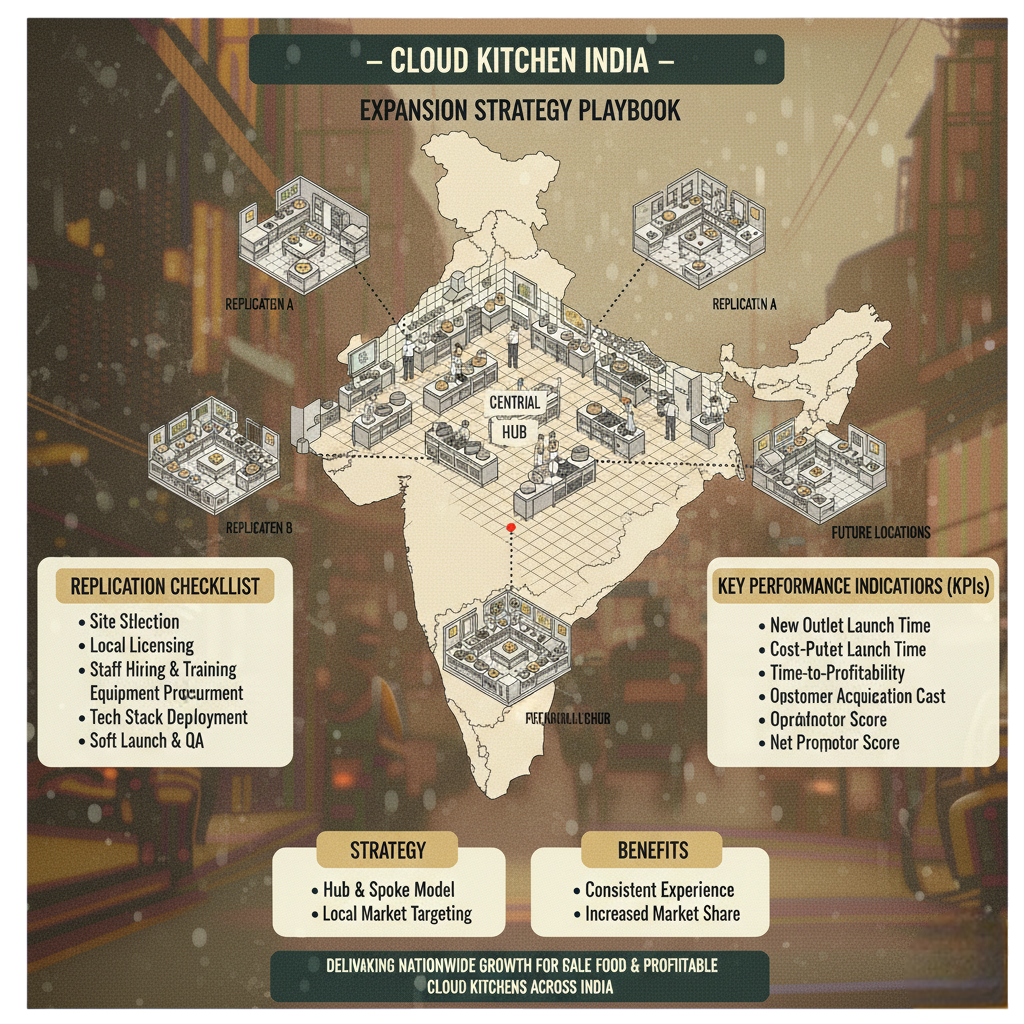

Choose Your Expansion Model: Distributed vs Centralized vs Hub-and-Spoke

Your expansion strategy depends on your menu and delivery promise. In India, the most common mistake is choosing a model based on rent availability, not on food quality decay and delivery radius. Use these decision rules:

- Distributed kitchens (multiple small units): best for freshness-sensitive menus and dense areas where 25–35 minute deliveries impact ratings.

- Centralized hub model: best for batch-friendly menus where procurement, consistency, and cost control dominate.

- Hub-and-spoke hybrid: central production + smaller dispatch/assembly points near demand clusters (best for large cities).

If you’re exploring the hub approach, read: For multi-location replication, use: How to Scale Cloud Kitchens.

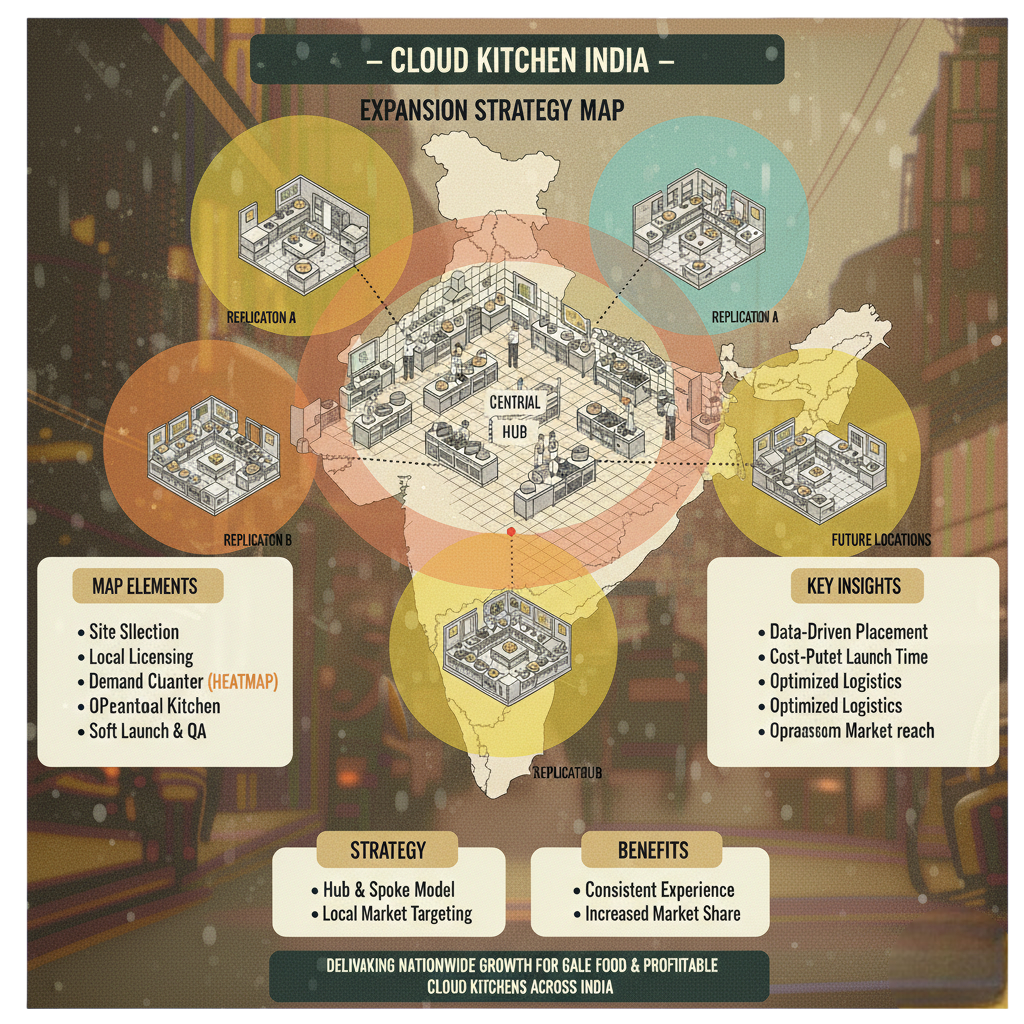

Location Selection: Expansion Is a Demand-Cluster Game

In India, expansion succeeds when your kitchen sits close to demand clusters and rider availability. A “great rent deal” in a low-demand pocket becomes a permanent marketing tax. Choose locations based on demand density, delivery time predictability, and operational access.

Practical filters founders should apply:

- Delivery time reliability (traffic pattern + peak-hour slowdown)

- Rider availability and dispatch congestion during dinner peaks

- Competitive intensity in your cuisine (not just total restaurants)

- Customer profile: office zones vs residential zones vs mixed pockets

- Kitchen operability: water, drainage, ventilation, and vendor access

For cost planning across new locations, use: Cloud Kitchen Setup Cost in India.

Unit Economics First: Expansion Must Protect Contribution Margin

Expansion gets expensive when founders chase GMV (gross revenue) instead of contribution margin. Your expansion strategy must start with the per-order math: food cost + packaging + aggregator commission + ads + labor allocation + refunds/credits.

Two realities in India make this even more important: aggregator commission pressure and discounting competition. If you scale a weak margin structure, you’ll increase revenue and still lose money.

Build your expansion model on margin fundamentals: Cloud Kitchen Profit Margin in India and check ROI assumptions here: Cloud Kitchen ROI in India.

For commission pressure, keep a strategy ready: How to Reduce Swiggy Commission.

Build a Replication Kit: The “New Kitchen Launch Box”

The fastest scaling cloud kitchens in India don’t reinvent the wheel for every location. They use a replication kit-one standard launch box that travels across units. Think of it as your operating system in a folder.

- Menu + pricing sheet (SKU list, portion rules, contribution margin targets)

- SOP stack (prep, cooking, packing, dispatch, hygiene, closing checks)

- Vendor master (approved vendors, specs, substitutes, reorder points)

- Training plan (7-day ramp: station-wise training + daily tests)

- Quality audit checklist (taste, temperature, packaging integrity, photo standards)

- Launch KPI dashboard (ratings, prep time, cancellations, refund rate, CM/order)

If you’re unsure about SOP coverage, benchmark against: Cloud Kitchen SOP Checklist.

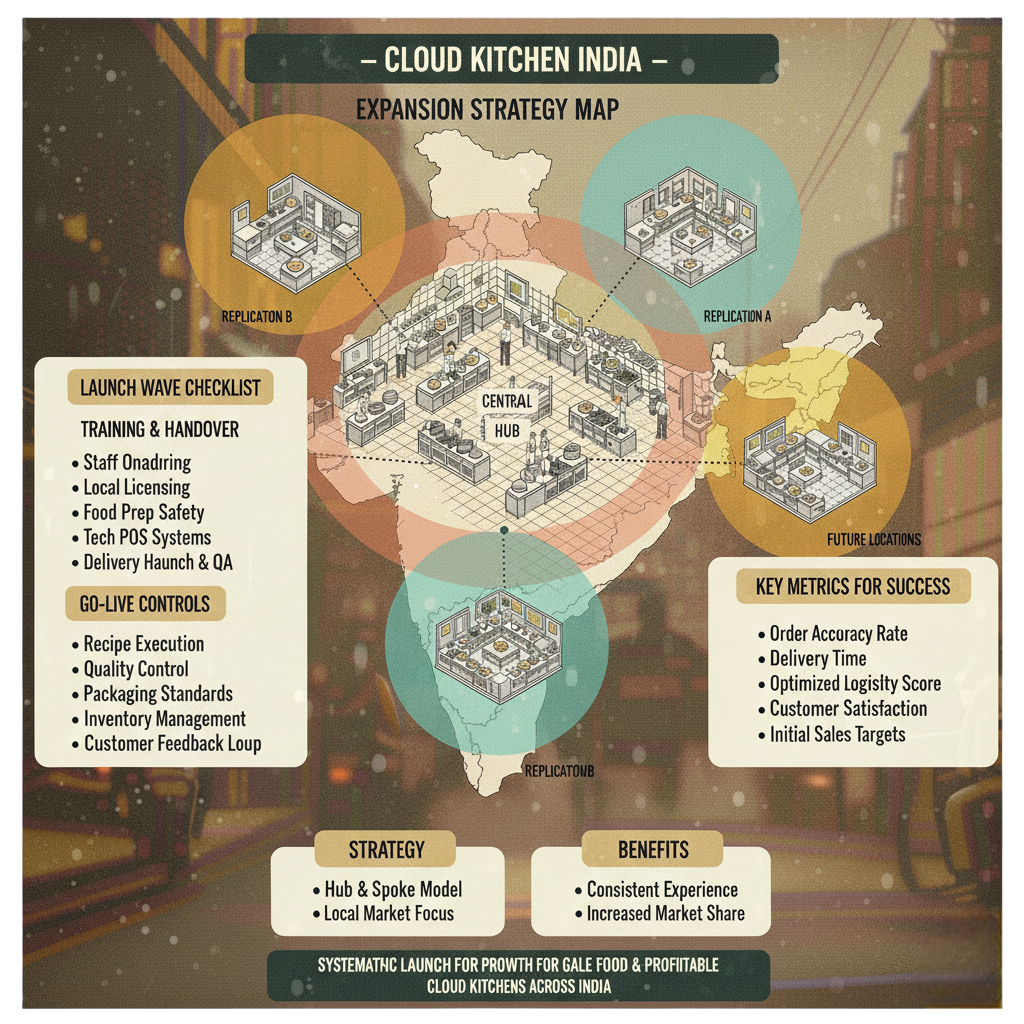

Expansion Waves: How to Scale 1 Kitchen to 10+ Without Chaos

Don’t expand in random bursts. Expand in waves with clear gates. A wave-based approach protects your ratings and operations because every new unit launches only after it passes a performance gate.

A practical wave plan used by high-control operators:

- Wave 1 (Kitchen #2): replication test. Same menu, same SOP, minimal changes. Prove copyability.

- Wave 2 (Kitchens #3–#4): add vendor redundancy, strengthen audits, standardize training.

- Wave 3 (Kitchens #5–#7): introduce hub components (central prep / shared bases) if needed.

- Wave 4 (Kitchens #8–#10+): optimize network (radius, dispatch points, SKU localization) without breaking SOPs.

Each wave should have a “go/no-go” gate: stable rating, stable margin, and controlled refunds. Expansion becomes predictable when gates are non-negotiable.

Operations Control: The KPIs That Predict Expansion Success

When you expand, you lose the ability to “feel” what’s happening inside every kitchen. Your strategy must replace gut with dashboards. These KPIs are the earliest warning signals:

- Contribution margin per order (by SKU + by channel)

- Prep-to-pack time and dispatch delay % during peaks

- Refunds/complaints (leakage, spillage, missing items, cold food)

- Rating stability (not just average rating-variance matters)

- Stock variance (purchase vs consumption mismatch)

- Repeat rate and cohort retention (week 1 → week 4)

Use outbound references to align internal checks with standard hygiene and food safety practices: FSSAI official guidance and food business taxation basics through GST Network.

Marketing During Expansion: Don’t Buy Demand You Can’t Fulfil

Most expansion failures aren’t because marketing didn’t work-they’re because marketing worked too early. Heavy ads bring a spike. If your kitchen isn’t trained, packaging isn’t validated, and prep stations aren’t stable, you’ll convert spend into bad ratings.

A safer expansion marketing approach:

- Soft launch (limited radius + limited SKUs for 7–10 days)

- Quality-first reviews (stability > speed; fix ops before scale)

- Scale ads only after ratings stabilize and refunds fall below a strict threshold

- Repeat loop (loyalty, WhatsApp/CRM, bundles) so you don’t remain discount-dependent

If you want to avoid the common traps, read: Why Cloud Kitchens Fail in India.

Final Thoughts: Cloud Kitchen Expansion Strategy in India

A cloud kitchen expansion strategy in India wins when you treat scaling like replication, not ambition. Stabilise one unit first. Choose the right model for your menu (distributed vs centralized vs hybrid). Build a replication kit. Expand in waves with gates. Track dashboards that reveal drift before it becomes damage.

The highest-performing operators expand with restraint: they protect margins, protect ratings, and build repeat demand. That’s how 1 kitchen becomes 10+ without turning into a refund machine.

FAQs: Cloud Kitchen Expansion Strategy in India

When should I expand my cloud kitchen to a second location?

Expand after your first kitchen has stable food cost %, consistent ratings, predictable dispatch times, and documented SOPs that don’t rely on founder supervision.

Which model is best for expansion: centralized or distributed?

Distributed kitchens are best for speed and freshness. Centralized kitchens are best for cost control and consistency. The best choice depends on your menu’s quality decay and your delivery-time promise.

What are the biggest reasons expansion fails?

Weak SOPs, poor vendor control, aggressive discounting, and scaling demand before operations are stable. These create low ratings, high refunds, and margin collapse.

How do I plan expansion in waves?

Launch Kitchen #2 as a replication test, then scale to #3–#4 with stronger audits and vendor redundancy. Add hub components later only if unit economics and quality remain stable.

- Cloud Kitchen Business in India

- Cloud Kitchen Setup Cost in India

- Cloud Kitchen Profit Margin in India

- Cloud Kitchen ROI in India