The Indian food delivery market has fundamentally changed how restaurants are built, scaled, and operated. Traditional dine-in models are being replaced by delivery-first setups that are faster, leaner, and far more capital-efficient. At the center of this shift lies the cloud kitchen business model in India is rapidly adopting across metros and Tier-1 cities.

For founders, operators, and investors, understanding how this model actually works on ground—not theory—is critical. This blog breaks down the real economics, execution challenges, and scalable frameworks that define success in the Indian context.

What is Cloud Kitchen Business Model in India

The cloud kitchen business model in India refers to a delivery-only food business that operates without a dine-in space. Orders are fulfilled exclusively through platforms like Swiggy, Zomato, or direct ordering channels.

Unlike traditional restaurants, cloud kitchens focus on operational efficiency, limited real estate, and digital demand capture. Kitchens are usually located in dense delivery zones rather than high-rent commercial areas.

This model allows founders to launch faster, test cuisines rapidly, and scale brands with significantly lower capital risk.

Why the Cloud Kitchen Business Model Matters in India

India’s urban food consumption behavior is uniquely suited to delivery-first formats. High population density, mobile-first users, and aggregator-led discovery make the cloud kitchen business model in India particularly effective.

Rising commercial rents, manpower costs, and regulatory burdens have made dine-in expansion increasingly risky. Cloud kitchens bypass many of these barriers while still tapping into massive daily demand.

For first-time founders and experienced restaurateurs alike, this model offers speed, flexibility, and data-driven decision-making that legacy formats struggle to match.

Cost Structure of Cloud Kitchen Business Model in India

Understanding cost is where most founders either win or collapse.

A typical cloud kitchen business model in India setup includes four primary cost buckets:

Setup Costs

Kitchen equipment, exhaust, refrigeration, and basic interiors typically range between ₹3–6 lakhs depending on cuisine complexity.

Monthly Fixed Costs

Rent, staff salaries, electricity, and internet usually fall between ₹60,000–₹1.2 lakh per kitchen in Tier-1 cities.

Variable Costs

Raw materials, packaging, and platform commissions form the largest variable expense. Food cost should ideally stay within 28–32% of revenue.

Marketing & Visibility

Promotions on aggregators and brand-level marketing consume 5–8% of monthly revenue if done strategically.

Cost discipline is what separates profitable kitchens from vanity brands.

Profitability Insights: What Actually Works

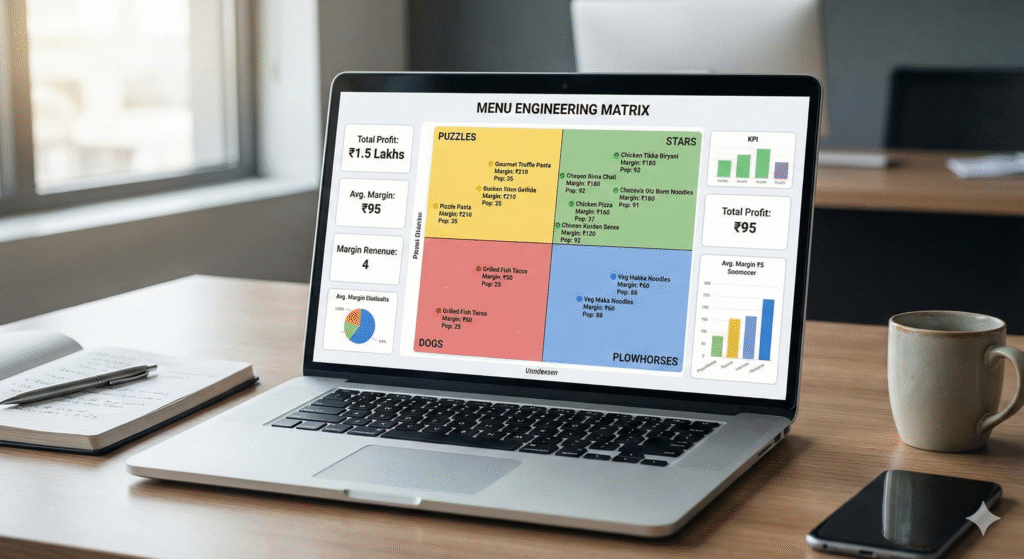

Contrary to popular belief, cloud kitchens are not low-margin by default. Profitability depends on menu engineering, kitchen throughput, and brand positioning.

In a well-run cloud kitchen business model in India, EBITDA margins of 18–25% are achievable once monthly order volumes cross stability thresholds.

High AOV cuisines, controlled SKU counts, and repeat customer strategies significantly improve unit economics. Multi-brand kitchens further amplify profitability by sharing rent, staff, and utilities.

Profit is not about volume alone—it’s about operational leverage.

Common Mistakes in Cloud Kitchen Business Model India

Most failures are execution-led, not idea-led.

One common mistake is launching too many cuisines without demand validation. Complexity kills margins faster than competition.

Another major error is poor location selection. Being visible on aggregators does not eliminate the importance of delivery-optimized catchments.

Founders also underestimate manpower planning, leading to service delays and rating drops that permanently damage ranking algorithms.

In the cloud kitchen business model in India, operational discipline is non-negotiable.

Scalable Execution Framework for Cloud Kitchens

Scaling requires structure, not hustle.

A proven cloud kitchen business model India framework includes standardized recipes, fixed prep SOPs, and predictable procurement cycles. Without this, multi-location expansion becomes chaotic.

Technology plays a key role. Central dashboards for order tracking, inventory, and pricing ensure consistency across kitchens.

Finally, brand architecture matters. Successful operators build focused brands rather than generic menus that confuse customers and algorithms alike.

Multi-Brand & Shared Kitchen Advantage

One of the biggest strengths of the cloud kitchen business model in India is the ability to run multiple brands from a single kitchen.

Shared infrastructure reduces fixed costs while increasing revenue per square foot. A single kitchen can profitably operate 3–5 complementary brands if menus are engineered correctly.

This approach dramatically improves capital efficiency and shortens payback periods—often under 9–12 months when executed well.

How GrowKitchen Solves This at Scale

GrowKitchen approaches the cloud kitchen business model India from an operator’s lens, not a theoretical one.

Instead of generic consulting, the focus is on execution-ready kitchens, demand-mapped locations, and SOP-driven operations. Brands are designed for aggregator performance, not just aesthetics.

The model emphasizes predictable costs, scalable systems, and profitability from month one—allowing founders to focus on growth instead of firefighting.

Expert Conclusion

The cloud kitchen business model India is not a shortcut it’s a structured business system. When executed with clarity on costs, menus, and scalability, it becomes one of the most capital-efficient ways to build a food brand in India today.

However, success requires operational maturity, not experimentation at scale. Founders who treat cloud kitchens like serious businesses not side hustles are the ones building defensible brands.

If you’re evaluating this model with long-term intent, strategic clarity upfront will save years of trial and error.

FAQs

Is cloud kitchen business model profitable in India?

Yes, when food costs, commissions, and manpower are controlled, EBITDA margins of 18–25% are achievable.

How much investment is needed to start a cloud kitchen in India?

A single kitchen typically requires ₹4–8 lakhs including setup and initial working capital.