Best Cities to Start a Cloud Kitchen in India

Not every city is equal for delivery-first food brands. In this guide, we break down the best cities to start a cloud kitchen in India based on demand, delivery ecosystem, competition, costs and growth potential-and how to choose the right city for your brand.

Why City Selection Matters for Cloud Kitchens

For a cloud kitchen, location is not about footfall - it’s about order density, delivery radius and demand patterns. The right city (and the right micro-market inside that city) can mean:

- Higher daily orders from the same kitchen

- Better average order value (AOV)

- Stronger repeat customers and better ratings

- Lower delivery times and fewer cancellations

The wrong city, on the other hand, can leave you stuck with rent, staff and aggregator commissions-but not enough orders to break even.

New to cloud kitchens? Start with: How to Start a Cloud Kitchen in India .

How We Evaluated the Best Cities

Instead of just listing “big cities”, we look at cloud kitchen opportunity through a few practical filters:

- Delivery app penetration: Swiggy, Zomato and quick-commerce presence.

- Order density: How frequently people order in key micro-markets.

- Spending power: Average order values for different cuisines.

- Competition: Are there too many options or quality gaps you can fill?

- Real estate & staff costs: Can you run a sustainable kitchen P&L?

- Cuisine–location fit: Some cuisines do better in specific cities.

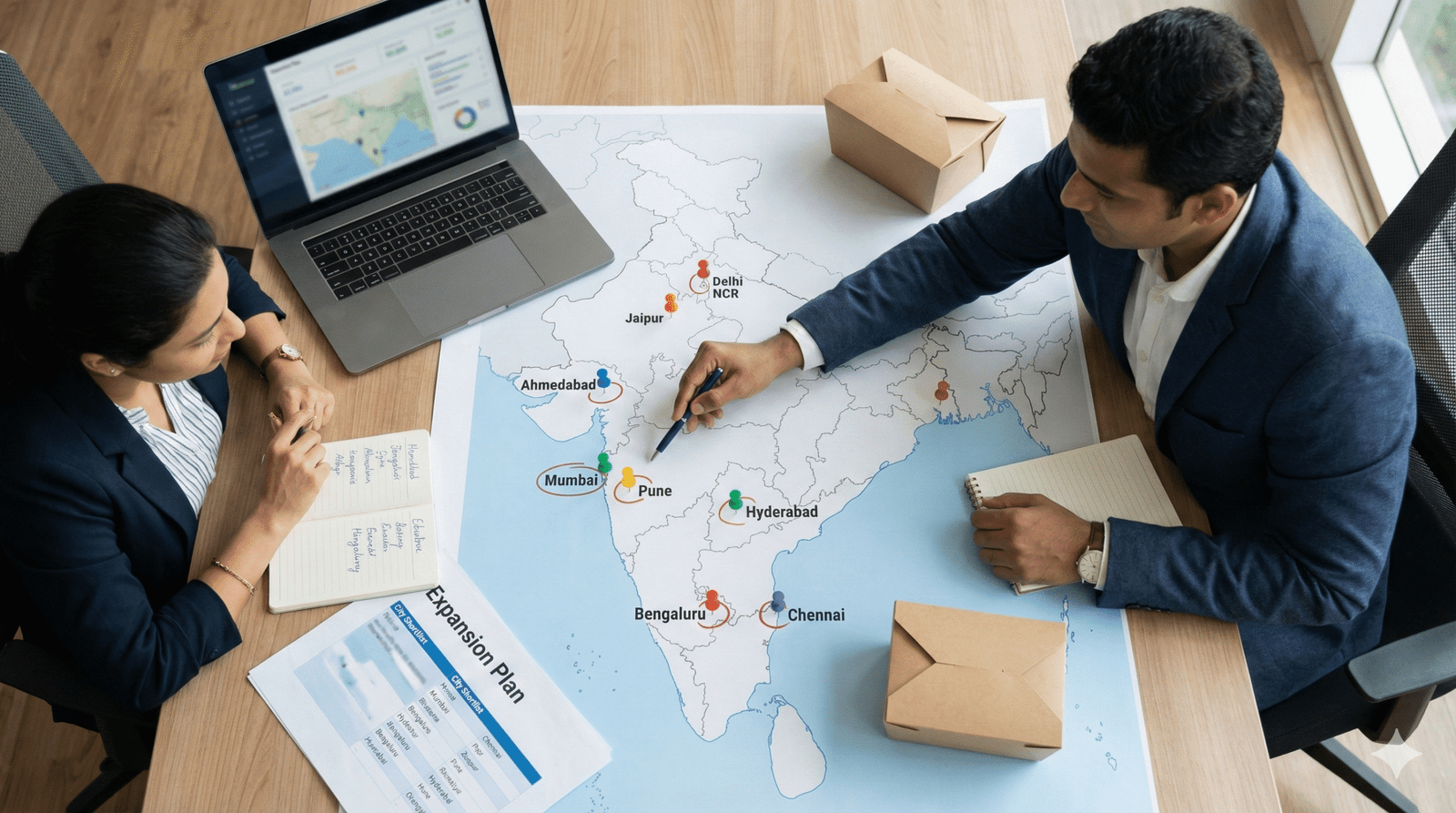

Top Tier 1 Cities for Cloud Kitchens in India

Tier 1 cities offer strong demand, high order frequency and mature delivery ecosystems - but also higher rentals and tougher competition. Here are some of the strongest options:

Mumbai & Mumbai Metropolitan Region (MMR)

Mumbai remains one of the most attractive markets for delivery-first brands:

- High order volume from office, residential and late-night segments

- Diverse demand-from budget meals to premium niche cuisine

- Strong presence of Swiggy, Zomato and quick-commerce players

Micro-markets like Powai, Andheri, Lower Parel, Thane and Navi Mumbai each behave like separate mini cities. You need to pick the right cluster based on your cuisine and pricing.

Pune

Pune combines a strong student, IT and young professional base with relatively better rentals than Mumbai:

- High delivery adoption in Kothrud, Hinjawadi, Baner, Viman Nagar, Kalyani Nagar etc.

- Good mix of budget and premium audiences

- Great test-bed city for new concepts before going pan-India

GrowKitchen currently operates multiple CKaaS kitchens in Mumbai & Pune - see: GrowKitchen CKaaS.

Delhi NCR (Delhi, Gurgaon, Noida)

NCR is one of the biggest food delivery markets in India. It offers:

- High order frequency across cuisines (North Indian, Biryani, Asian, Fast Food)

- Strong late-night and weekend demand

- Opportunities in both budget segments and premium clusters

Bengaluru

Bengaluru’s young workforce, IT parks and startup culture make it attractive for:

- Healthy, functional foods and subscription-friendly concepts

- Experimental cuisines - ramen, Korean, artisanal burgers etc.

- High repeat potential if your food travels well in rain-heavy months

Hyderabad, Chennai & Other Major Metros

Cities like Hyderabad and Chennai combine strong local food cultures with large working populations, which creates great opportunities for:

- Regional cuisine cloud kitchens

- Modern formats for biryani, tiffin, grills and snacks

- Hybrid brands - local flavours with modern packaging and branding

High-Potential Tier 2 Cities

Tier 2 cities are rapidly catching up in delivery adoption. They usually have:

- Lower rental and staff costs

- Less intense competition in niche categories

- Growing middle class and smartphone penetration

Examples of Emerging Tier 2 Markets

Depending on your cuisine and operational capability, cities like Jaipur, Indore, Ahmedabad, Surat, Kochi, Lucknow, Chandigarh, Coimbatore and others can be strong plays. Many of these cities:

- Have active Swiggy and Zomato presence

- Are under-served in premium and niche categories

- Offer good ROI for focused, well-positioned brands

Before finalising a Tier 2 city, spend time studying the “Top brands” and “Popular near you” sections on delivery apps. Look for cuisine gaps and rating gaps you can fill.

Micro-Markets & Neighbourhood Clusters Matter More than the City

Inside every city, performance varies massively by micro-market. For example, owning a kitchen in the right street of Kothrud (Pune) can be far better than being in a random part of a bigger city.

When analysing a micro-market, look at:

- Order heatmap: How many outlets are busy in your cuisine?

- Delivery radius: How many high-density societies or offices within 3–5 km?

- Competition quality: Are top listings actually good or just “first movers”?

- Real estate mix: Is the area mostly residential, commercial or mixed?

How to Choose the Right City for Your Cloud Kitchen Brand

Instead of asking “Which city is best?”, ask:

- Who is my target customer? Students, IT employees, families, office goers?

- What price band am I in? Budget, mid-premium, or premium?

- What cuisine am I offering? Mass favourite vs niche vs health-oriented?

- How many outlets do I eventually want? One city domination or multi-city?

A Simple 4-Step Location Decision Flow

- Shortlist 3-5 cities where your target customer is dense.

- Inside each city, shortlist 3-5 micro-markets using delivery app research.

- Compare rentals, staff availability and expected order flow.

- Pick 1-2 test locations, run focused pilots, then scale to more kitchens.

Need help with this process? You can book a session via: GrowKitchen Contact.

See this - LinkedIn

Don’t Want to Gamble on City Choice? Use CKaaS

Choosing and setting up a kitchen in a new city can be risky and capital-heavy - especially if you don’t have on-ground experience there.

That’s where Cloud Kitchen as a Service (CKaaS) comes in. Instead of:

- Setting up your own kitchen from scratch in every city

- Signing long leases without proven demand

- Hiring and training staff city by city

You plug your brand into a ready network of operational kitchens.

With GrowKitchen CKaaS , you can:

- Launch in proven micro-markets of Mumbai & Pune

- Use existing staff, vendor networks and operational SOPs

- Focus on product, brand and marketing instead of daily kitchen management

For a deeper model breakdown, read: What is CKaaS? Cloud Kitchen as a Service Model Explained .

FAQ: Best Cities to Start a Cloud Kitchen

Which city is best to start a cloud kitchen in India?

There is no single “best” city. Mumbai, Pune, Delhi NCR, Bengaluru, Hyderabad and Chennai are strong Tier 1 options. But the right choice depends on your cuisine, pricing, target audience and ability to operate in that city.

Are Tier 2 cities better for cloud kitchens?

Tier 2 cities can offer lower rentals and less competition, but may also have lower AOV and fewer high-frequency segments. They work very well for focused, localised brands with tight cost control.

Can I start in a smaller city and later expand to metros?

Yes. Many brands prove their unit economics in smaller cities and then use that playbook to enter metros. Just make sure your cuisine, pricing and packaging are metro-ready.

Is it risky to start in a big metro as a first-time founder?

It can be, because costs are higher and mistakes are more expensive. This is where models like CKaaS or partnering with experienced operators can reduce risk.

How many kitchens should I plan per city?

Start with 1–2 high-quality, well-placed kitchens. Once your operations, reviews and P&L are stable, then roll out more kitchens based on real demand heatmaps – not guesswork.

Want Help Picking the Right City and Micro-Market?

GrowKitchen works with food founders to shortlist cities, select micro-markets, design menus and plug into ready CKaaS kitchens in Mumbai & Pune – so you don’t waste time and money on the wrong location.

Book a Location Strategy CallGet a Custom Cloud Kitchen Plan for Your Brand

Not sure how to start or scale your cloud kitchen in India? Share a few details about your brand and we’ll send you a personalised setup and growth roadmap.

- City-wise kitchen and location suggestions

- Approximate investment & profit estimates

- Menu and positioning recommendations

- Whether CKaaS or own kitchen suits you better

Fill the form and our team will get in touch within one working day.

About Us

Ckaas Sloutions

Contact

Follow On

© 2025 Grow Kitchen. All rights reserved.

WhatsApp us