Is CKaaS really profitable, or does the management fee and aggregator commission eat all your margins? In this guide, we break down the actual cost structure of CKaaS, show sample P&L numbers, and explain what realistic profit percentages founders, influencers and restaurant owners can expect from a cloud-kitchen-as-a-service model.

Is CKaaS Profitable? The Short Answer

The honest answer: yes, CKaaS can be profitable, but only when your menu, pricing, ratings and marketing are set up correctly. CKaaS is not a magic shortcut-it’s a different way of structuring costs and risk.

In a traditional cloud kitchen, you invest heavily upfront and then hope to recover that investment over 2-3 years. In CKaaS, you shift from heavy capex to a clear monthly operating fee, which makes profitability easier to understand and track every month.

What Does “Profit” Actually Mean in CKaaS?

Many first-time founders confuse revenue, contribution margin and net profit. To know if CKaaS is working for you, you need to separate these clearly.

1. Revenue (Top Line)

This is the total monthly sales from Swiggy, Zomato and any direct orders. For example, ₹7,00,000 per month from one kitchen.

2. Contribution Margin (After Direct Costs)

This is what’s left after food cost, packaging and aggregator commission. A healthy delivery brand usually aims for 50-60% contribution margin before fixed costs and CKaaS fees.

3. Net Profit (After All Operating Costs)

After you subtract CKaaS fee, marketing, discounts, refunds and any other overheads, what’s left is your net profit. This is the real money the brand makes every month.

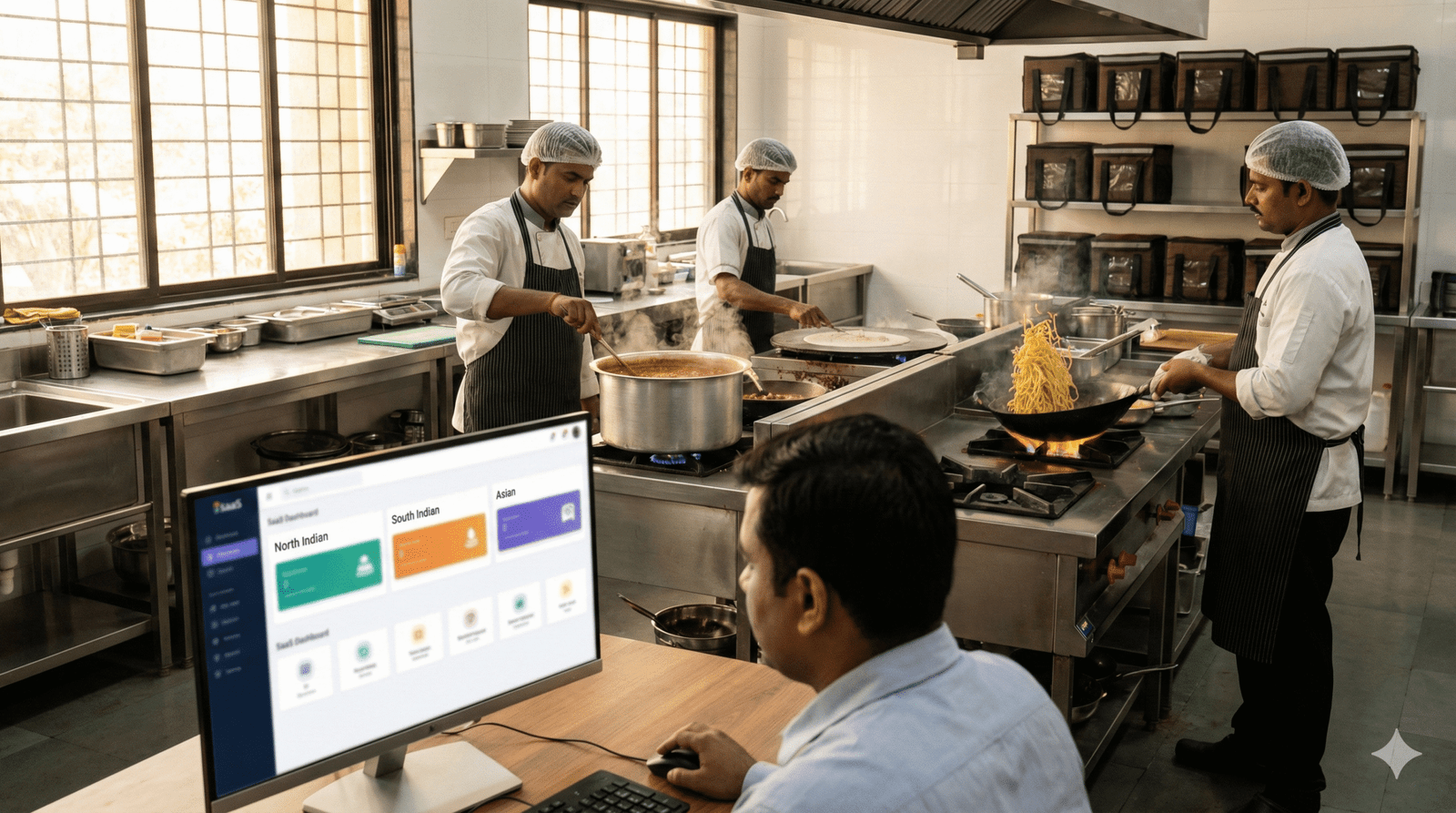

Typical CKaaS Cost Structure (Per Kitchen)

Exact numbers vary by cuisine and city, but most CKaaS brands deal with similar cost buckets:

- Food cost-raw materials and central prep (usually 30–38% of sales)

- Packaging-boxes, containers, cutlery (3–5% of sales)

- Aggregator commission-Swiggy/Zomato fees (20–28% of sales)

- CKaaS fee-monthly management fee or fee + revenue share

- Marketing & discounts-platform ads, coupons, creatives

- Misc-refunds, wastage, payment gateway or software tools

Your goal is to design the menu and pricing such that, after all these costs, you still make a healthy net margin on a monthly basis.

Sample CKaaS P&L-One Kitchen, One Brand

Here’s an illustrative example to understand how CKaaS profitability works. Let’s assume:

- Monthly revenue: ₹7,00,000

- Average order value: ₹450-₹500

- City: Tier 1 micro-market with decent demand

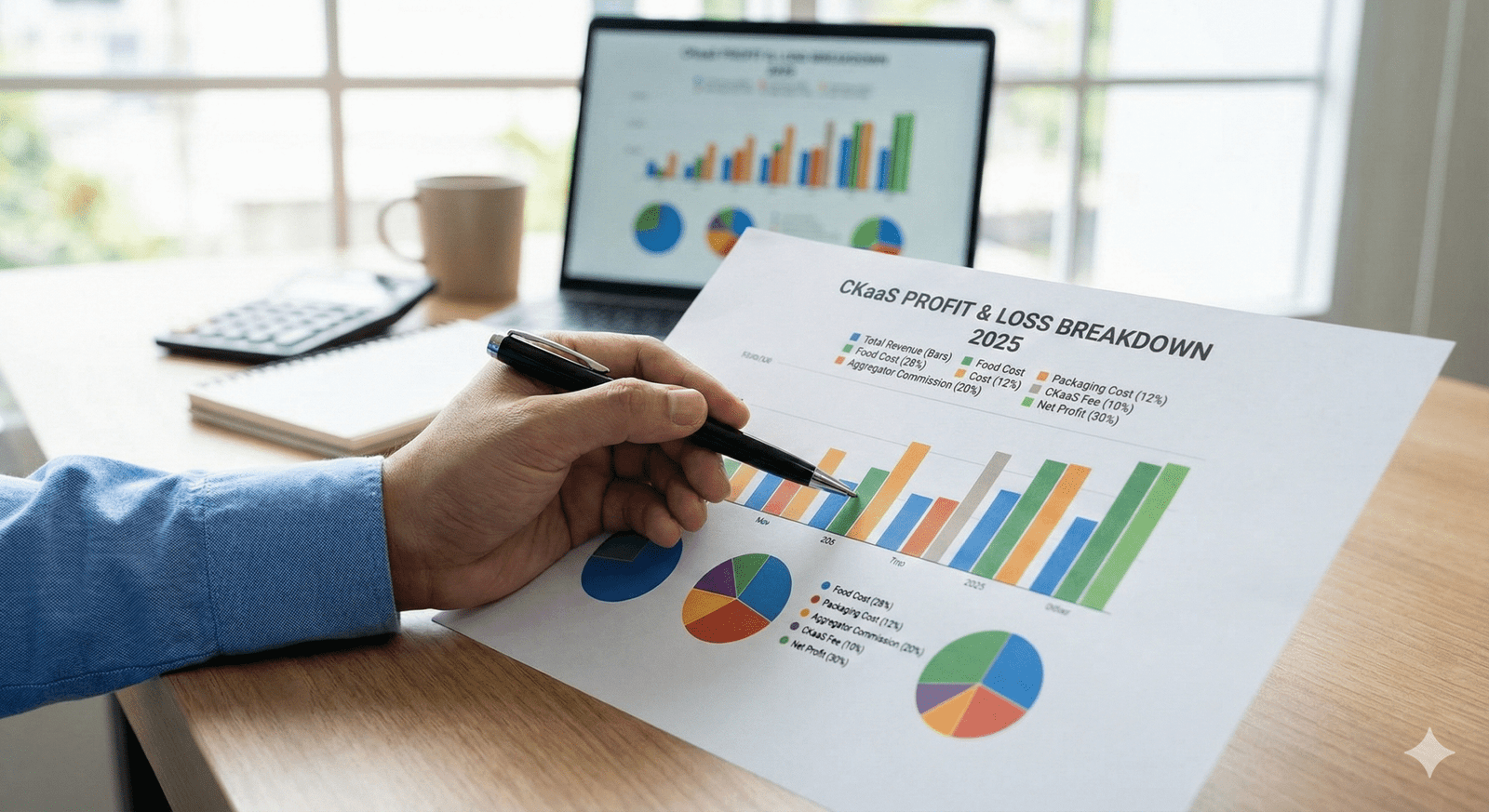

Monthly P&L Snapshot (Illustrative)

- Revenue: ₹7,00,000

- Food cost (35%): ₹2,45,000

- Packaging (4%): ₹28,000

- Aggregator commission (25%): ₹1,75,000

- CKaaS management fee: ₹35,000

- Other costs (3%)-refunds, tools, etc.: ₹21,000

Net profit = ₹7,00,000-(2,45,000 + 28,000 + 1,75,000 + 35,000 + 21,000) = ₹70,000, which is a 10% net margin.

Break-even Point: How Much Revenue Do You Need?

Break-even in CKaaS is the revenue level at which your contribution margin covers your CKaaS fee and marketing, with zero or small profit.

Example: Targeting 10% Net Profit

If your contribution margin is ~55% and your fixed costs (CKaaS fee + marketing + tools) are around ₹2,50,000, then you need approximately:

- ₹4,50,000–₹5,00,000 in monthly revenue to hit break-even

- ₹6,50,000–₹7,00,000+ in monthly revenue to reach 10-12% net profit

These numbers will shift based on your cuisine, pricing band, location, and how aggressive you are with discounts and ads.

What Are Good Margin Targets in CKaaS?

While there is no one-size-fits-all number, these are common benchmarks many delivery-first brands aim for in CKaaS:

- Food cost: 30-35% (up to 38% for premium cuisine)

- Contribution margin: 50-60%

- Net profit (per kitchen): 8-15% after all operating costs

In the early months, it’s normal to operate at lower margins (or even small losses) while ratings, reviews and repeat orders build up. The key is to have a clear glide path to profitability over 6-12 months.

When Does CKaaS Fail to Be Profitable?

CKaaS is not automatically profitable. Brands struggle when one or more of these issues show up consistently:

- Low average order value-selling items too cheap while paying full aggregator commission and packaging costs.

- Uncontrolled food cost-poor portioning, wastage, inconsistent recipes.

- Weak ratings-under 4.0 stars leads to lower visibility and higher discount pressure.

- Over-discounting-permanent 40–60% discounts with no strategy to phase them out.

- Too many slow-moving SKUs-complex menu that increases prep cost, errors and wastage.

A good CKaaS partner will flag these issues early and help re-engineer the menu and pricing instead of simply chasing more orders at any cost.

How to Improve CKaaS Profitability

If your CKaaS brand is getting orders but profit is thin, these levers usually move the needle fastest:

1. Menu Engineering

Focus on 15-25 high-contribution dishes, reduce low-margin SKUs and introduce smart combos that increase average order value without increasing food cost proportionately.

2. Portion & SOP Control

Tighten recipes, portion sizes and prep SOPs. Even a 2–3% saving in food cost can add meaningful profit at scale.

3. Smarter Discounts & Ads

Use discounts tactically-for new area entry, weekday slumps or new SKU launches – instead of permanent blanket offers that eat margins for repeat customers.

4. Ratings & Repeat Orders

Nudge customers to leave reviews, fix negative feedback quickly and build recall via packaging inserts and social media. Higher ratings usually mean better organic visibility, lower dependence on heavy discounts.

5. Multi-Brand Stacking

In some cases, stacking 2-3 complementary brands in the same micro-market via CKaaS can increase total revenue per kitchen and improve overall profitability per location.

FAQ: People Also Ask About CKaaS Profitability

How long does it take for a CKaaS brand to become profitable?

With a good concept, strong SOPs and consistent marketing, many brands see a clear path to break-even within 4-6 months and healthier profits in 6–12 months, depending on cuisine and ticket size.

What net profit percentage should I target?

For most delivery-first brands, a 10–15% net profit per kitchen is a solid target once the brand is stable. Higher is possible in premium niches with strong pricing power.

Is CKaaS more profitable than opening my own kitchen?

CKaaS usually has lower risk and faster payback because you avoid heavy capex. Your percentage margin might be similar, but your capital efficiency and speed of scaling are typically better with CKaaS.

Can influencers or creators make good money with CKaaS?

Yes-if they leverage their audience trust, charge a sensible premium and partner with a CKaaS team that can deliver consistent quality, many creators can build profitable, multi-city delivery brands.

Want to See If CKaaS Can Be Profitable for Your Brand?

GrowKitchen’s CKaaS network in Mumbai & Pune lets you test and scale food brands with clear cost structures, transparent reporting and outcome-focused operations-so you know exactly where every rupee of profit is coming from.

Book a CKaaS Profitability Call